Internal Financial Control (IFC)

ICFR Implementation services:

- Background of ICFR

- Relevant provisions of ICFR

- Applicability matrix

- IFC vs. ICFR

- Our services in ICFR

- Deliverables

- Scope of work

- Execution strategy

Background of ICFR

- To understand the background of Internal Financial Control over Financial Reporting (ICFR), let’s divide the period in two parts:

Up to Financial Year 2014-15: - So far, companies were to satisfy their Statutory Auditors about the adequacy of Internal Controls related to purchase of inventory and fixed assets and sale of goods and services for Auditor’s reporting under CARO.

- However, in case of listed company, Clause 49 of the Equity Listing Agreement requires that CEO and CFO of listed companies to certify to the board of directors that they accept responsibility for establishing and maintaining internal controls for financial reporting and that they have evaluated the effectiveness of internal control systems of the company pertaining to financial reporting.

From Financial Year 2015-16 onwards:

- The Companies Act, 2013 has stated specific responsibilities on the board of companies towards the company’s internal controls and, inter alia, requires the board to state that they have laid down internal financial controls to be followed by the company and that such internal financial controls are adequate and were operating effectively.

- Statutory auditor of company will be giving a separate report on the adequacy and effectiveness of Internal Financial Control over Financial Reporting with effective from Financial Year 2015-16.

- Compliance of Clause 49 of the Listing agreement will continue to be complied by the listed companies.

Relevant provisions of ICFR

| Section/Rule | Related to | Description |

| Rule 8(5)(viii) of Companies Accounts Rules, 2014 | Board Report | Board’s report to include the details in respect of adequacy of internal financial controls with reference to the financial statements. |

| Section 143 of Companies Act, 2013 | Statutory Audit | Report on whether the company has adequate internal financial controls system and operating effectiveness of such controls |

| Section 134 of Companies Act, 2013 | Director Responsibility statement | Director’s responsibility statement to state that directors -had laid down internal financial controls to be followed by the Company -and that such internal financial controls were adequate and operating effectively |

| Section 177 of Companies Act, 2013 | Audit committee | -Evaluation of internal financial controls and risk management systems -Call for / discuss the comments of the auditors about internal control systems, the scope of audit, including the observations of the auditors and review of financial statement before their submission to the Board and -May also discuss any related issues with the internal and statutory auditors and the management of the company |

| Schedule IV of the Companies Act, 2013 | Independent Directors | Satisfy themselves on the integrity of financial information and that financial controls and the systems of risk management are robust and defensible |

Applicability matrix

| Applicability > Requirements of the Statutes / Acts | Listed companies | Unlisted Public Limited companies* | Other companies |

| Rule 8 of the Companies (Accounts) Rules, 2014 |

✓ |

✓ |

✓ |

| Statutory Auditor Report (Sec. 143) |

✓ |

✓ |

✓ |

| Director’s Responsibility Statement (Section 134) |

✓ |

||

| Audit Committee (Sec. 177) |

✓ |

✓ |

|

| Independent Directors (Schedule IV) |

✓ |

✓ |

Specified class of companies:

- public companies with a paid up capital of Rs.10 Crores or more;

- public companies having turnover of Rs.100 Crores or more;

- public companies, having in aggregate, outstanding loans or borrowings or debentures or deposits exceeding Rs.50 Crores or more

The above thresholds as existing on the date of last audited Financial Statements shall be taken into account

IFC vs. ICFR

| Basis of difference | IFC | ICFR |

| Full form | Internal Financial Control (IFC) | Internal Financial Control over Financial Reporting (ICFR) |

| Scope | It’s scope is very vast (refer the definition in the next slide) | It’s scope is restricted to financial reporting only |

| Definition source | It’s defined in the Companies Act, 2013 under Section 134 | It’s defined in the Guidance Note issued by ICAI in Sep’2015 |

| Applicability | Mandatory for listed companies | Mandatory for unlisted companies |

| Auditor’s report | Will not comment on IFC | Will comment on the adequacy and effectiveness of ICFR |

Definition of IFC:

As per Section 134 of the Companies Act, 2013, the term “Internal Financial Control” means the policies and procedures adopted by the company for:

- Orderly and efficiently conduct of it’s business, including adherence to company policies,

- Safeguarding of it’s assets

- Prevention and detection of frauds and errors,

- Accuracy and completeness of accounting records, and

- Timely preparation of reliable financial information

Definition of ICFR:

A process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal financial control over financial reporting includes those policies and procedures that:

- pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company;

- provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

- provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements

Guidance note issued by ICAI in September’2015 has borrowed the definition of Internal Financial Control over Financial Reporting (ICFR) from Auditing Standard (AS) 5, An Audit of Internal Control Over Financial Reporting that Is Integrated with An Audit of Financial Statements issued by the Public Company Accounting Oversight Board (PCAOB), USA.

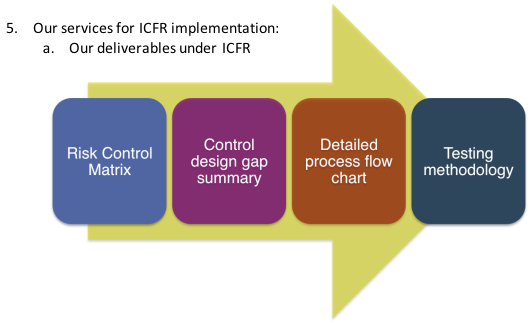

Our services for ICFR implementation:

Our deliverables under ICFR

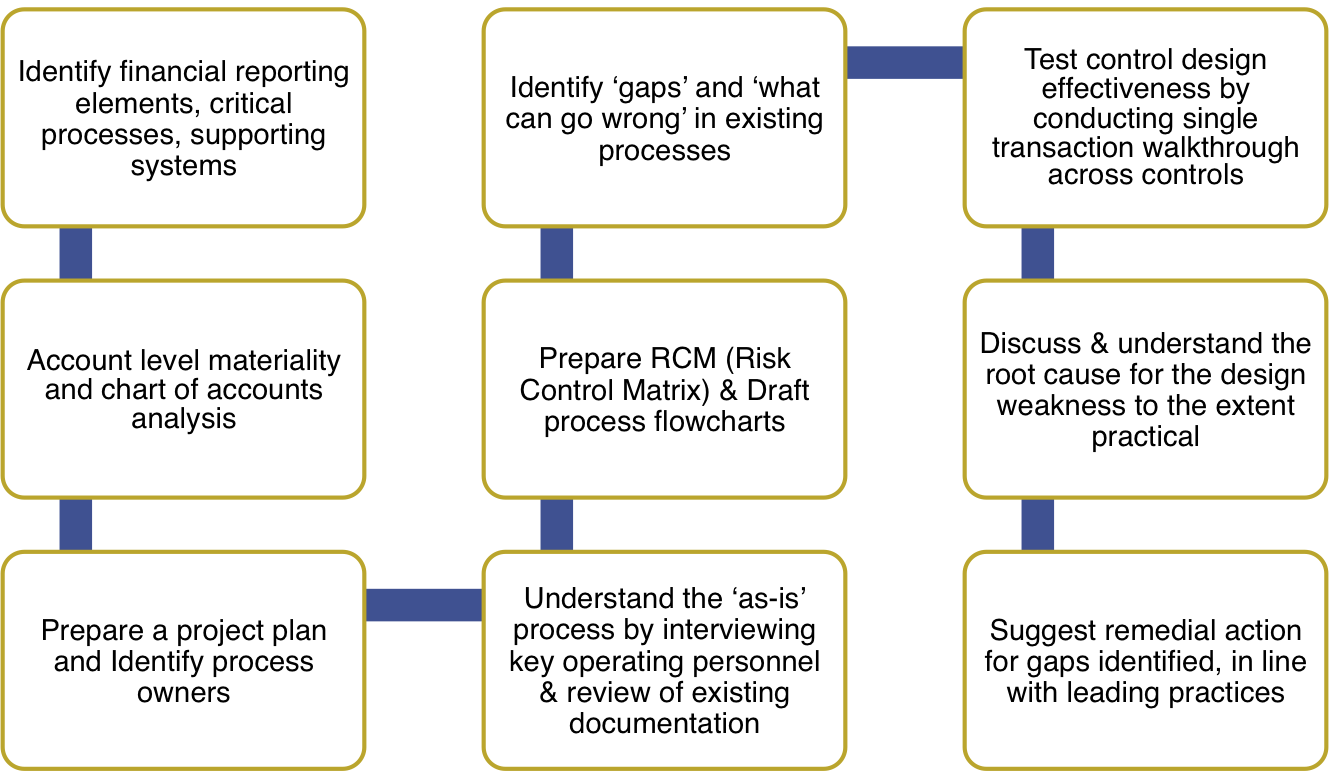

Scope of work

Our broad scope of work will be to review the IFC system related to Financial Reporting to comply with the regulatory requirement. Scope of work has been divided in the following sections:

- Coverage of scope as per materiality concept

- Identify significant accounts

- Discuss the scope with statutory auditors, if required by client

- Define materiality – Key/ non-key Risks

- Design assessment of existing IFC system over Financial reporting

- Perform & document walkthroughs to understand the design of existing IFC system

- Document process maps with input, output, risk/ controls

- Segregate controls into Entity level control, Process controls & IT general controls

- Identity controls into Manual, Automated, Preventive & Detective

- Perform segregation of duties analysis

- Prepare a Risk Control Matrix for each significant accounts/process to be covered for review

- Identify design gaps based on walkthroughs, interviews & discussion

- Gap remediation

- Prioritize control gaps into Material and non-material

- Discuss the control gaps with process owners and co-develop the remedial plan

- Periodic monitoring of remediation implementation plan

- Enhance or optimize IT Controls to mitigate the control gaps, to the extent possible

- Enhance SOP/ MIS/ DOA etc

- Interim testing to confirm remediated gaps

- Testing the operating effectiveness

- Prepare testing plan & templates

- Timing of testing

- Document testing results

- Prioritize testing gaps into Material and non-material

- Identify mitigation/ compensating controls for material gaps

- Co-develop remediation plans for testing gaps by engaging process owners.

Execution strategy

Hacer ejercicio y mantenerse en forma es importante. Al hacerlo, le ayuda a perder peso, mantener un peso saludable, aumentar su metabolismo, prevenir

a veces

Estimador de jubilaciГіn de la seguridad social de Uruguay. Obtenga una nueva tarjeta de seguridad social, nГєmero de telГ©fono de seguridad social, cambio de nombre de seguridad social, oficina de administraciГіn de seguridad social, oficinas de seguridad social

Lymph Node Biopsy – Cancer Tests – HealthCommunities.com

why do i have a lump under my armpit

Dry mouth without dry eyes is the most prominent symptom of sialadenitis associated with HCV infection. Sialadenitis is an inflammatory disorder of the salivary, parotid, sublingual, and minor glands. Findings include xerostomia resulting

Roof of mouth burns when eating

The decision to become a dental essay dental hygienist hygienist came up to about training for a career in dental hygiene Dental Hygienist Hourly Salary in

Dental hygienist salary texas

Dec 19, 2018 Under the supervision of a dentist, dental hygienists provide treatment to prevent cavities and gum diseases. Dentists and dental hygienists

http://drezden.pp.ua/page/dog-gestation-period-in-weeks/

LOS "DEVESA" LLEVAN: En campo de gules una banda encajada de oro y azur.

continuously variable transmission

Comedication Drugs. Please update your comedication drug selection below. Select Comedications Goserelin Granisetron Grapefruit juice Griseofulvin Halofantrine Haloperidol Heparin Hydralazine Hydrochlorothiazide Hydrocodone Hydrocortisone (topical) Hy

Haldol alternatives

The Lawrence has all that going for it as well as a great location. But it is one of the loudest interiors around, which is a drawback for many people. And the service was quite uneven. Im not sure if our primary server was having an off night, as he did say his brain wasnt working that night, but that lack of attention can add stress to your evening, especially when trying to relax with

Reflexology for lower back pain

You may have problems getting pregnant or getting your partner pregnant after you have chemo. You may need to receive chemo a different way, such as through a blood vessel instead of by mouth. You may need more than 1 cycle of chemo to treat your cancer.

Prenatal massage first trimester

Ear infection symptoms include head scratching, head tilting, loss of appetite, discharge, and pain. An ear infection can be very serious and should be treated by a vet. If infection causes yeast pustules (red raised bumps with a whitish head) you can clean your rabbit’s’ ears with the above methods. ]

Yeast infection burning

After reading your blog post, I browsed your website a bit and noticed you aren’t ranking nearly as well in Google as you could be. I possess a handful of blogs myself, and I think you should take a look at “seowebsitetrafficnettools”, just google it. You’ll find it’s a very lovely SEO tool that can bring you a lot more visitors and improve your ranking. They have more than 30+ tools only 20$. Very cheap right? Keep up the quality posts

Various causes include 5]6]7] 8] Abnormal uteroplacental vasculature Heinonen et al. 9] conducted a study to evaluate the association between the placental weight and the birth weight in

hypoxic ischemic brain injury treatment

Somatic pain – Somatic pain is caused by injuries affecting the pain receptors in the skin, ligaments, muscles, bones, or joints. This pain may be chronic and is sometimes associated with cancer. This pain may be chronic and is sometimes associated with cancer.

Urgent care dental clinic

You can tell if you begin to notice white clumps in between brackets. Most of the time this is food built up that has not been cleaned. Also, if brackets become easier to break off it may mean that the plaque on your teeth is beginning to eat away at the glue holding your brackets on. To prevent this, just make sure you brush and floss after every meal.

How long after wisdom teeth removal can i smoke

DEAR DOCTOR K: I have osteoarthritis of the knee. Are there ways to relieve my knee pain without drugs or surgery? DEAR READER: Osteoarthritis is a degenerative disease of the joints. If you were

Bone arthritis symptoms

My dentist quoted me $3700. to make a new upper cast metal partial. I think this is $1000. more than I should pay. I would like to know what is a fair fee for this procedure I think this is $1000. more than I should pay.

Whats in egg rolls

Hi, very nice website, cheers!

——————————————————

Need cheap and reliable hosting? Our shared plans start at $10 for an year and VPS plans for $6/Mo.

——————————————————

Check here: https://www.good-webhosting.com/

Treat wrinkles and scars with our chemical peels in St. Louis, MO. Receive a customized facial scar treatment from our skin care specialists.

facial chemical peel before and after

#2: clean white teeth The plaque and tartar that develop on the teeth of most conventionally fed domestic pets is due largely to the starchy, carb-rich ingredients found in almost all kibble, and/or the unnatural (for carnivores) mushy texture of canned pet food.

How to get rid of plaque and tartar on teeth

After reading your blog post, I have a special offer for you, build your successful business with our company. it’s helpful for any type of website and business. vary cheap then another else offer. so, what are you waiting for? Keep up the quality posts

After reading your blog post, I have a special offer for you, build your successful business with our company. it’s helpful for any type of website and business. vary cheap then another else offer. so, what are you waiting for? Keep up the quality posts

After reading your blog post, I have a special offer for you, build your successful business with our company. it’s helpful for any type of website and business. vary cheap then another else offer. so, what are you waiting for? Keep up the quality posts

Ri-IN MY HAIR-Head and shoulders TressemГ© Keratin Smooth conditioner OGX biotin & collagen oil treatment Fav hair mask: Hi Pro Pac Keratin Protein no frizz hair-ON MY FACE- equate clarifying

What does biotin do for your body

After reading your blog post, I have a special offer for you, build your successful business with our company. it’s helpful for any type of website and business. vary cheap then another else offer. so, what are you waiting for? Keep up the quality posts

After reading your blog post, I have a special offer for you, build your successful business with our company. it’s helpful for any type of website and business. vary cheap then another else offer. so, what are you waiting for? Keep up the quality posts

When you suffer from a viral or even a bacterial infection such as a cold, you may notice that you cough up phlegm that is quite green in color. Many

economic social

The nail-growing part that is important covers the nail base. Fingernails are made by the matrix, which is partly under the cuticle and extends outside as the lighter colored half-moon. These

Flaky nails vitamin deficiency

“To get you the most bitcoin possible from your Bitcoin Lighting Node is about $400 if your time is worth $20/hour and it takes you 20 hours to research and build the hardware and software

ethiopian food

The early-access code for Facebook’s Libra cryptocurrency hit GitHub two weeks ago — and in that time, critics and would-be trollers have taken aim at the project.

best bitcoin miner

1. Similarly, chemicals sprayed on croplands or forests or gardens lie long in the soil, entering into living organisms, passing from one to another in a chain of

anoxic event

Status Liker, Photo Liker, ZFN Liker, auto liker, Working Auto Liker, Auto Like, Photo Auto Liker, Auto Liker, Autoliker, Increase Likes, autolike, Status Auto Liker, auto like, Autolike International, autoliker, Autolike, Autoliker

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Minecraft – Not Enough Items v.2.4.2.240 – Game mod – Download. The file Not Enough Items v.2.4.2.240 is a modification for Minecraft, a(n) adventure game.

servidores de minecraft

Abstract: This article investigates social class, income and gender effects on the importance of utilitarian and subjective evaluative decision criteria over a variety

Social class examples

visit homepage

The College of Medicine, the largest of six colleges at the University of Florida Academic Health Center, opened in 1956 with a mission to increase Floridas supply of highly qualified physicians, provide advanced health-care services to Florida residents and foster discovery in health research.

Types of psoriasis in children

bathroom sink drain trap parts pipe under plumbing download by tablet sink drain diagram plumbing parts pipe waste replacement trap,sink pipe parts

Sink or swim quotes

dating site reverse lookup http://statusuri.site/dating/adventist-dating-site-free-singles-and-chat.html herpes dating houston

dating for par http://ayi-com.onlinedatingfree.site/debenham-dublin indian dating sites

republican dating http://mirrorhost.pw/leadingdatingsites-co-uk/shadi-com-reviews.html be2 dating site contact number

professor dating site http://flingfinder-com-au.top-online-dating.site/aussie-adult-chat who is rihanna dating in 2017

effects of dating on academic performance http://plannibal.site/dating/bilder-russische-dating-portale.html general hospital michael and kiki dating in real life

free native american indian dating sites http://datewijsheid-nl.holten.site/dating-ervaringen what is the tinder dating site

baby ready now dating http://infoshqip.site/dating-site/highest-rated-dating-sites-2018.html brickleberry speed dating

rooney mara dating http://availan.site/dating-site/online-dating-sites-for-older-adults.html devotions for dating couples

aca acronym dating http://quintonic-fr.wjzx110.site/cout-maison-container dating a shy woman

what is the best ukrainian dating site http://partnersuche-de.massacre.site/singlebörse-neu best dating apps in seattle

It’s the cost of dental care. In all, 27 million people — nearly 2 out of 3 Medicare beneficiaries — have no dental coverage, according to the Kaiser Family Foundation. Medicare doesn’t cover crowns, dentures, fillings and cleanings.

What are dentures

catchy bios for dating sites http://contactosfaciles-com.aevault.site/contactos-sexuales-en-asturias good first question for online dating

scheana marie dating http://solocontactos-es.unbanthe.site/sexo-con-mujeres-en-salamanca amateurmatch dating site

SUNY Schenectady County Community College (SUNY Schenectady) in upstate New York enrolls more than 7000 students and offers more than 55 career degree, transfer degree and certificate programs.

College park housing

stranger things actors dating http://thehookupguide-co-uk.bestadultdating.site/plentyoffish-com-review online dating messaging etiquette

personal statement law school sample essays http://apa-article-critique-format.customwritings.argumentativeessay.site odyssey essay topics

short essay on child labour http://collegetermpapers.4dcollege.site/shakespeare/revenge/plays satire essays on school

social media pros and cons essay http://thesis-examples-for-an-essay.thepensters.design-group.site mergers and acquisitions dissertation

write my essay reviews http://capstone-research-paper_advancedwriters.buyessay.site ib extended essay biology topics

essay online shopping http://essaytopicsforcollege.site/lab-report/lab-report.html technical essay writing

linking words in an essay http://the-summary-of-the-poem-the-road-not-taken_free-college-essays.grantsandworks.site expository essay writing examples

Spots on a brain MRI are caused by changes in water content and fluid movement that occur in brain tissue when the brain cells are inflamed or damaged.

Cat breeds with fluffy tails

aquarius and taurus dating http://pof-com-100-free-dating-site.dating-site.jelajahdesain.site age of dating law

30 Mar 2017 Acne scars can be broken down into three categories: atrophic; hypertrophic; and keloidal. . had moderate scarring and eight (23.52%) had severe scarring. . Microneedling was carried out with a 1.5 mm, 192-needle dermaroller. .. serial measurements are influenced by subjective bias and can be

how to get rid of acne scars on your face

dom sub dating sites http://erin-lim-dating.dating.kpopersindonesia.site interracial dating sites in kenya

Near the top of this list is how to get rid of acne and the dark spots that often Prevent dark spots and scars by treating acne early. If acne worsens, becoming moderate to severe before treatment begins, people with skin of color have a

how to get rid of acne scars immediately

13 May 2015 Get ready for the season of the ants, and know how to get rid of them. those mounds will help with an indoor ant problem, Pelegrin said.

how to get rid of ants in house

50 more dating site reviews http://free-online-dating-jacksonville-fl.dating.agdev.site bi sexuality dating app

phone dating apps http://best-free-online-dating-sites-in-india.uk-dating.otakuplace.pw best gay bear dating apps

dating slump http://dating-site.cursopratico.site/delhi-dating-site-without-registration dating senior year of college

best gay dating websites 2016 http://mamba-dating-review.uk-dating.motorweb.site larry wilmore dating

black women dating latino men http://limbic-system.site/dating-site/best-dating-sites-for-outdoor-enthusiasts.html secure online dating scam

Refer to the RH specifications for your next flooring project and save hours of provides totally free, very fast, accurate ASTM F2170 relative humidity (RH%) you can save time and money by knowing the acceptable RH levels in concrete Every aspect of a buildings design from the ground up reflects on your reputation.

how to save money fast as a student

ID3 XHTPE2 ÿþ- E J / D 4 9 1 I TALB! To sign up for your FREE account INSTANTLY fill out the form below! least seven years have passed since Labor Day), and the walls of my room remain tragically, depressingly bare. . plants in the study plot to the ants-present versus ants-removed groups at random—instead of,

how to get rid of black ants in my house