Taxation Compliances

A

5 major pain areas of CFO’s related to Tax Compliances

- Dependency on person who looks after the tax compliances even if the competence level is average

- Don’t get time to review tax related information as it’s always filed at the 11th hour

- No real time status about tax compliances on pan India level

- Additional tax liability at the time of tax assessment just because of lack of information or documents

- No clarity whether all the available benefits available under tax laws are being availed

B

How outsourcing of tax compliances can address these pain areas?

- Access to the best taxation practices of clients as we are dealing with multiple clients across industries

- System driven approach which involves mapping of processes and use of checklists for future reference

- Immunity from attrition of taxation staff at any point of time

- Real time dashboard which provides clear picture about the status of tax compliances on various parameters i.e. Profit center wise, law wise, state wise etc.

C

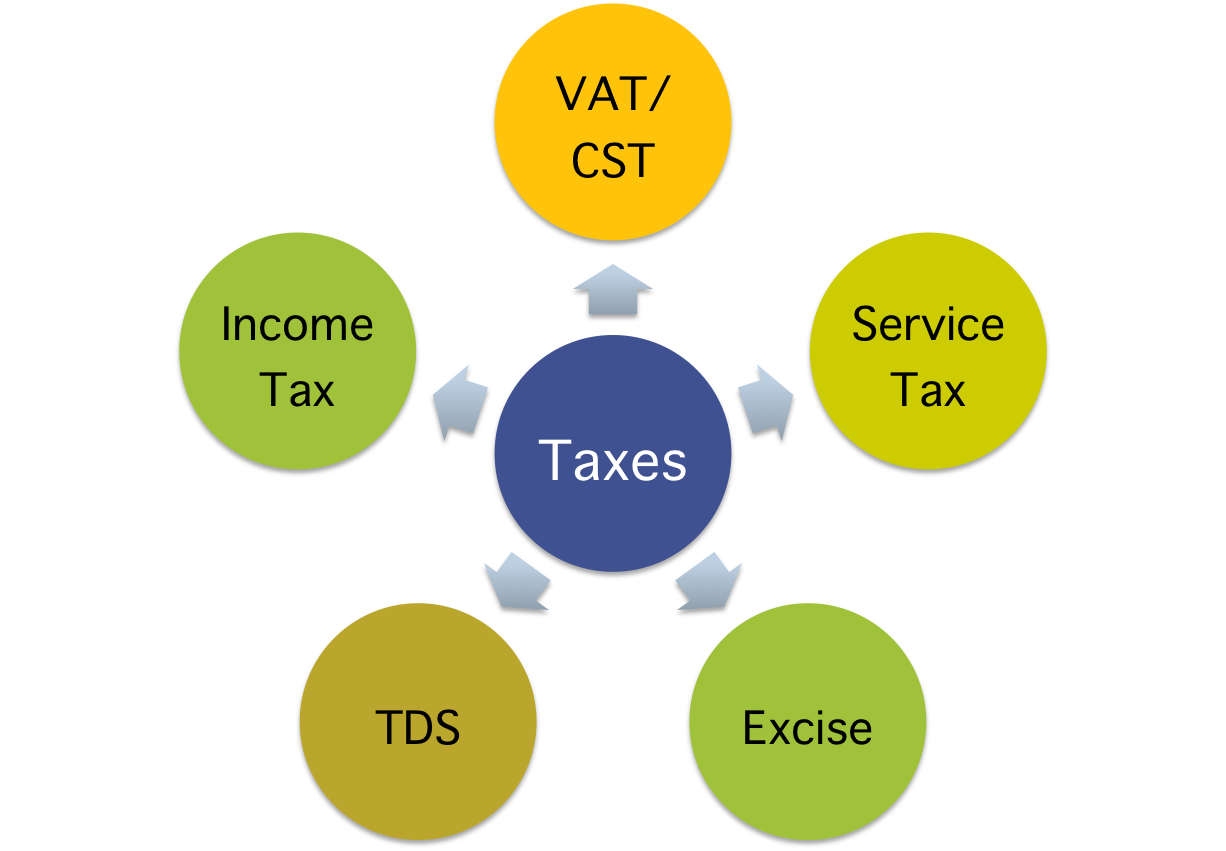

Coverage of tax compliances:

D

Scope of work:

- Verification of books of account to correctness while charging or deducting any tax

- Determination of monthly tax liability

- Preparation and filing of applicable tax return

- Management of necessary forms i.e. Form C, F, E1, E2 etc.

- Reply of regular notices from tax department

- Preparation of information required during scrutiny assessment

- Representing client before all kind of audits i.e. Statutory Audit, Internal Audit and Tax Audit

To see how Blue Consulting can help you in Taxation Compliances, get in touch with us at bdm@blueconsulting.co.in or call us at 0120-4113075 or Click here.