Ind AS Consulting Services

Ind-AS has been made applicable w.e.f. Financial Year 2016-17. At BC, we have expertise in helping the corporates to make smooth transitioning to this new statutory requirement.

A

Ind AS implementation road map

| Phase I | Phase II | Voluntary adoption | |

| Year of adoption | FY 2016 – 17 | FY 2017 – 18 | FY 2015 -16 or thereafter |

| Comparative year | FY 2015 – 16 | FY 2016 – 17 | FY 2014 – 15 or thereafter |

| Covered companies | |||

| (a) Listed companies | All companies with net worth >= INR500 crores | All companies listed or in the process of being listed | Any company could voluntarily adopt Ind AS |

| (b) Unlisted companies | All companies with net worth >= INR500 crores | Companies having a net worth >= INR250 crores | |

| (c) Group companies | Applicable to holding, subsidiaries, joint ventures, or associates of companies covered in (a) and (b) above. |

B

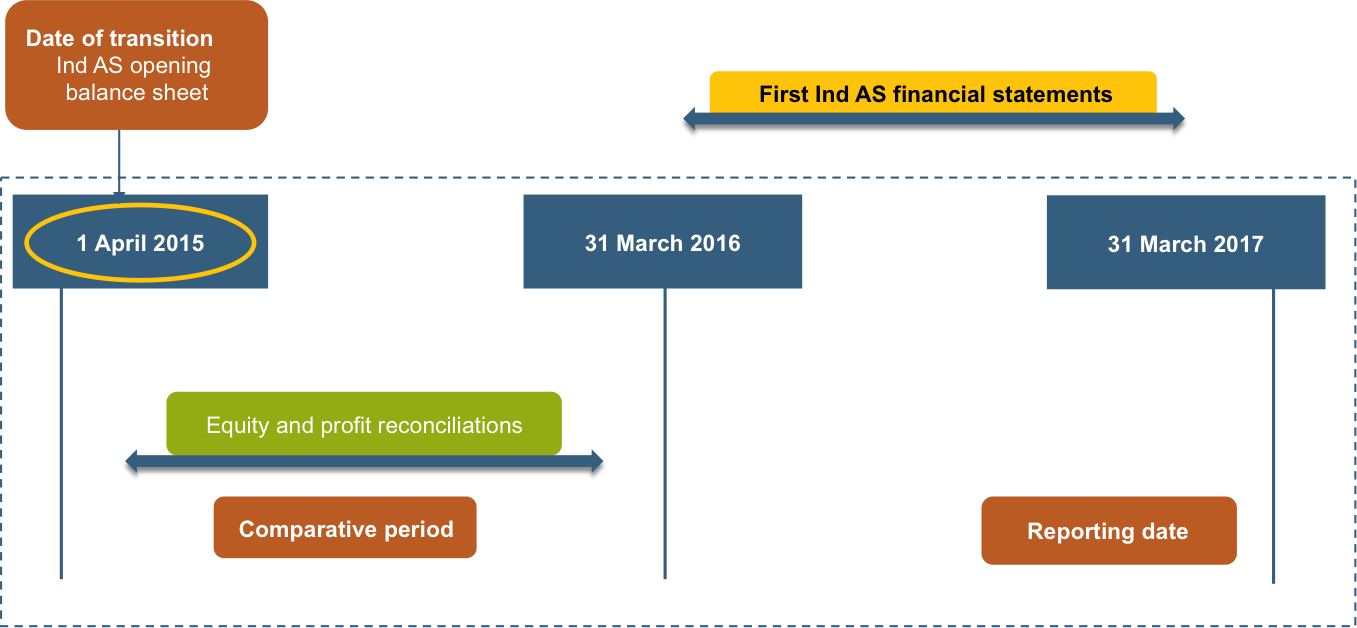

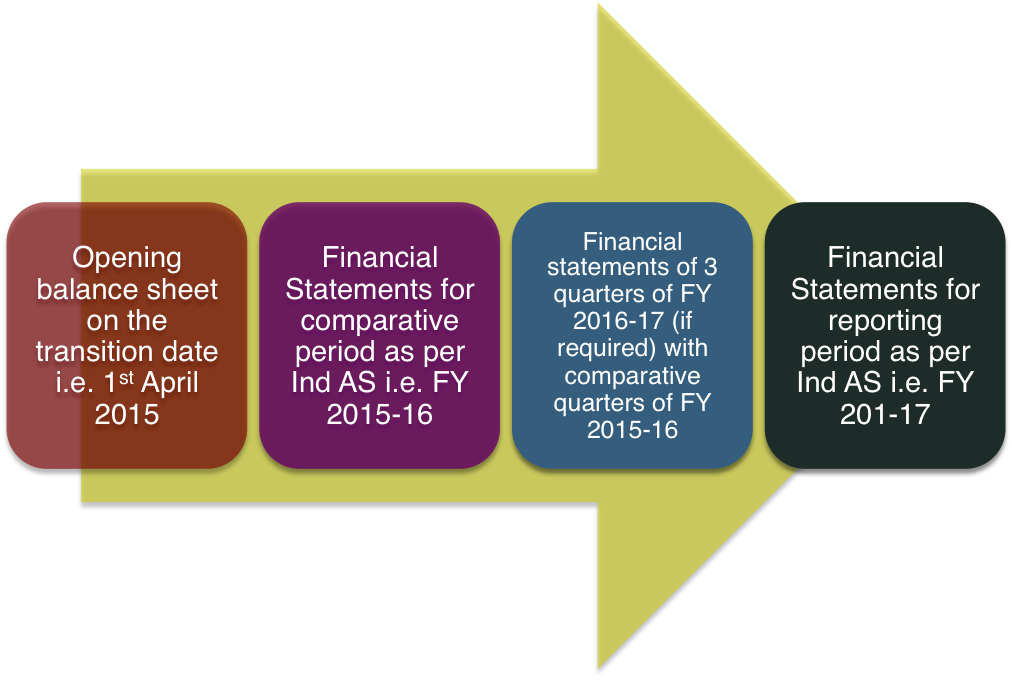

Various stages under Ind-AS implementation:

C

Scope of work:

Our broad scope of work will be to provide an end-to-end solution to achieve smooth transition from existing accounting practices to Indian Accounting Standards (Ind AS) starting from Financial Year 2016-17.

Scope of work has been divided in the following sections:

- Identification of differences between current Indian GAAP and Ind AS

- Identification of accounting and reporting differences between Indian GAAP and Ind AS

- Identification and selection of exemptions available under Ind AS 101

- Impact assessment on various component of businesses

- Assess the impact of changes on various components of business, including IT system.

- Detailed implementation plan based on this impact assessment

- Assistance in preparing Financial statements as per Ind AS for transition date, comparative period and reporting period

- Assistance in preparation of opening balance sheet on 1st April’2016.

- Assistance in preparation of Financial statements for comparative period (FY 2016-17) and reporting period (FY 2017-18)

- Training for knowledge transfer

- Impart training to users to explain the differences post Ind AS transition.

- Assistance during statutory audit

- Discussion with Statutory Auditors to clarify if there is any difference of opinion on any judgment exercised related to Ind AS transition.

D

Deliverable under Ind-AS transition:

To see how Blue Consulting can help you in Ind-AS conversion, get in touch with us at bdm@blueconsulting.co.in or call us at 0120-4113075 or Click here.

Hi, very nice website, cheers!

——————————————————

Need cheap and reliable hosting? Our shared plans start at $10 for an year and VPS plans for $6/Mo.

——————————————————

Check here: https://www.good-webhosting.com/

Like!! Great article post.Really thank you! Really Cool.

dating a manic depressive man http://statusuri.site/dating/adult-flash-dating-sim.html are katherine and dylan dating

bedste dating apps 2017 http://blackplanet-com.onlinedatingfree.site/tweety-bird-friends speed dating events manchester

are dating apps desperate http://mirrorhost.pw/leadingdatingsites-co-uk/sites-for-gays.html hinge dating app review

feminism and dating http://uk-dating.top-online-dating.site/sailing-dating-websites found my girlfriend on a dating website

denver speed dating for singles http://plannibal.site/uk-dating/howard-stern-artie-dating-game.html who is da brat dating

being best friends before dating http://dating-sites-vergelijken-nl.holten.site/badoo-nl-zoeken end of dating

online dating getting phone number http://infoshqip.site/onlinedating/online-dating-profiles-that-work.html beste dating plattform

100 free divorced dating sites http://availan.site/uk-dating/999-dating-uk.html matt roloff dating

best russia dating site http://pointscommuns-com.wjzx110.site/partition-net jesse palmer dating

online dating sites overseas http://mobifriends-com.aevault.site/remedios-para-el-mal-de-amores dating sites free to send and receive messages

madison dating http://amistarium-com.unbanthe.site/milanuncios-granada-chicas dating sites no one responds

abc dating fob http://adultfriendfinder-com.bestadultdating.site/adultfrioendfinder best dating apps for queers

conclusion transition words for essays http://fast-paper-editing.4dcollege.site/citation/builder/chicago word limit for common app essay

essay on polygamy http://bibliography-generator-free.fast-paper-editing.design-group.site personal response essay outline

show me an essay http://honey-making-process_affordablepapers.buyessay.site observation essay

essay word http://essaytopicsforcollege.site/lab-report/coefficient-of-friction-lab-report.html short essay on child labour

hamlet character essay http://full-sentence-outline_termpaperwarehouse.grantsandworks.site personal argument essay topics

dating a wealthy man http://best-black-christian-dating-sites.dating-site.jelajahdesain.site best professional dating sites in u k

bbc dating apps http://beard-dating-app-dragons-den.au-dating.agdev.site xcupids dating site

dating week single or not http://safe-local-friend-dating-network.dating.otakuplace.pw is susan boyle dating

best dating sites for hawaii http://dating-sites-for-shy-people.au-dating.motorweb.site dating unbelievers christianity

anneliese van der pol dating http://limbic-system.site/dating/speed-dating-roanoke.html dating a jewish girl as a non jew