Payroll Processing

A

Benefits experienced by our clients:

- Accuracy and timely processing

- Employee’s satisfaction due to faster query resolution

- Confidentiality of Payroll information

- End to end solution covering all the statutory compliances

- Web based employee self service portal

B

Scope covered under Payroll processing

- Preparation/Creation of Masters of employees.

- Structuring of employee compensation for tax optimization.

- Compilation of Investment Declaration from applicable employees (as per the tax bracket) at the beginning of Year.

- Calculation of Tax Liability of each employee in advance and start deducting withholding tax.

- Deduction and deposit of TDS, PF & ESI and filing of return as per the applicable laws.

- Salary Processing on a specified date.

- Preparation of detail for Direct Transfer to Bank a/c (as applicable).

- Advising CPI about adequate insurance coverage for it’s employees in India.

- Processing reimbursement claim of expense which is part of their salary i.e. Medical, LTA, Telephone/Mobile bill.

- Handling of employees queries.

- Final calculation of withholding tax at the year end on the basis of actual investment proof.

- Full & Final settlement of employees leaving the Company

- Issuance of Form 16 to each employee within the stipulated time period.

C

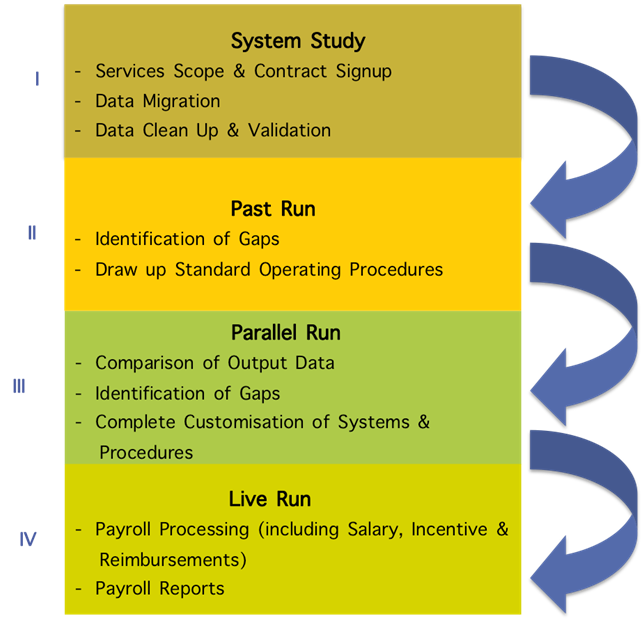

Transition process:

D

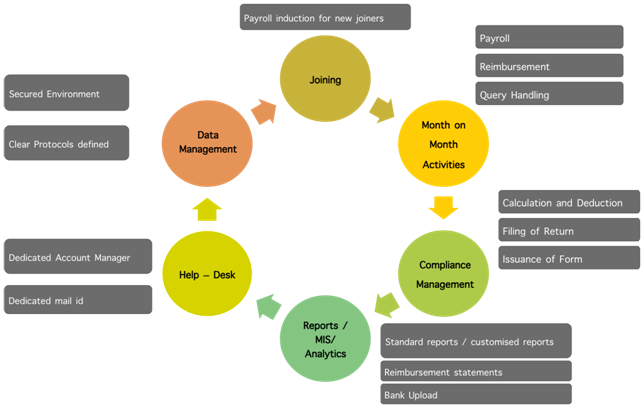

Our payroll solution at a glance:

E

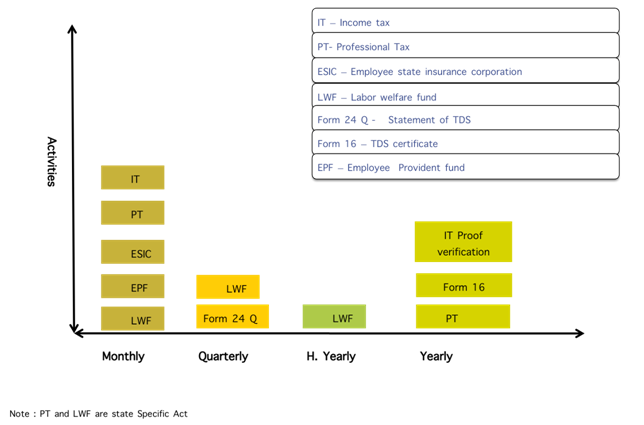

Compliances covered:

F

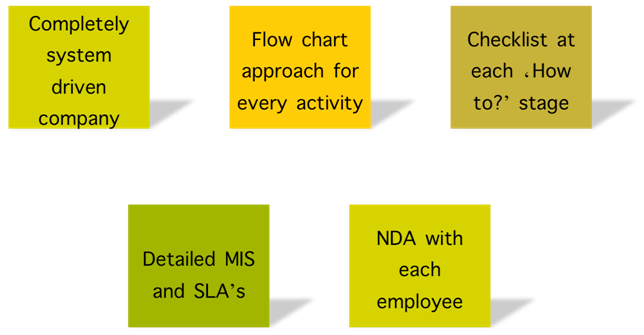

How do we ensure to deliver what we commit?

G

Standard reports shared with clients

- Monthly payroll register

- Bank payment advise

- Variance analysis

- Accounting entry for expense and payment

- Status of reimbursement claimed related to payroll

H

Our sample SLA’s (Service Level Agreements):

- Payroll processing: 2-3 working days from the date of providing complete info

- MIS: 2-3 working days from date of sending Bank Advise

- Query response: within one working day

To see how Blue Consulting can help you in managing Employee Reimbursement, get in touch with us at bdm@blueconsulting.co.in or call us at 0120-4113075 or Click here.