Compliance Audit

A

Problems faced by companies related to Compliance Management

- Lack of clarity regarding whether a company is complying with all the applicable compliances as per the nature and size of business.

- Difficult to ascertain completeness of documentary evidence (i.e. Challans, Returns, Orders, Supporting documents in the form of Annexures, reconciliations) of the various compliances

- Limitation of Internal Auditors adopting transaction oriented approach, which focusses more on errors or non-compliance in TDS, VAT, Service Tax etc.

- Internal Tax team is usually busy responding to the urgencies related to Scrutiny Assessment, Return filing, filing of reply to various notices etc.

B

How Compliance Audit can solve these problems?

We have a dedicated compliance audit team which comprises of experts in various laws. This team keeps a regular track of ongoing changes in various compliances applicable on different businesses across industries.

This team is regularly trained about the approach of carrying out compliance audit. There are many standardized self developed forms and checklists which are used while carrying out audit.

C

Coverage of type of compliances

- Direct Taxes (Income tax)

- Indirect taxes (Customs, Excise, Service Tax, VAT, Entry tax, Entertainment Tax)

- Corporate laws (Companies Act, FEMA )

- Employee benefit laws (PF, ESI, Gratuity, Bonus, Sexual Harassment Act etc.)

- Industry specific laws ( STPI & SEZ, Environmental laws, Real Estate related laws etc.)

- Others (Shop & Establishment)

D

Scope of work

- Review the applicability of various compliances as per the nature and size of business

- Review the completeness of documentation related to applicable compliances

- Verify the claim and utilization of tax credit available under various indirect taxes

- Verify the returns filed under applicable Laws and Statutes.

- Status of maker checker approach and controls related to correct and timely deposit of dues

- Suggestions to improve the compliance management system

E

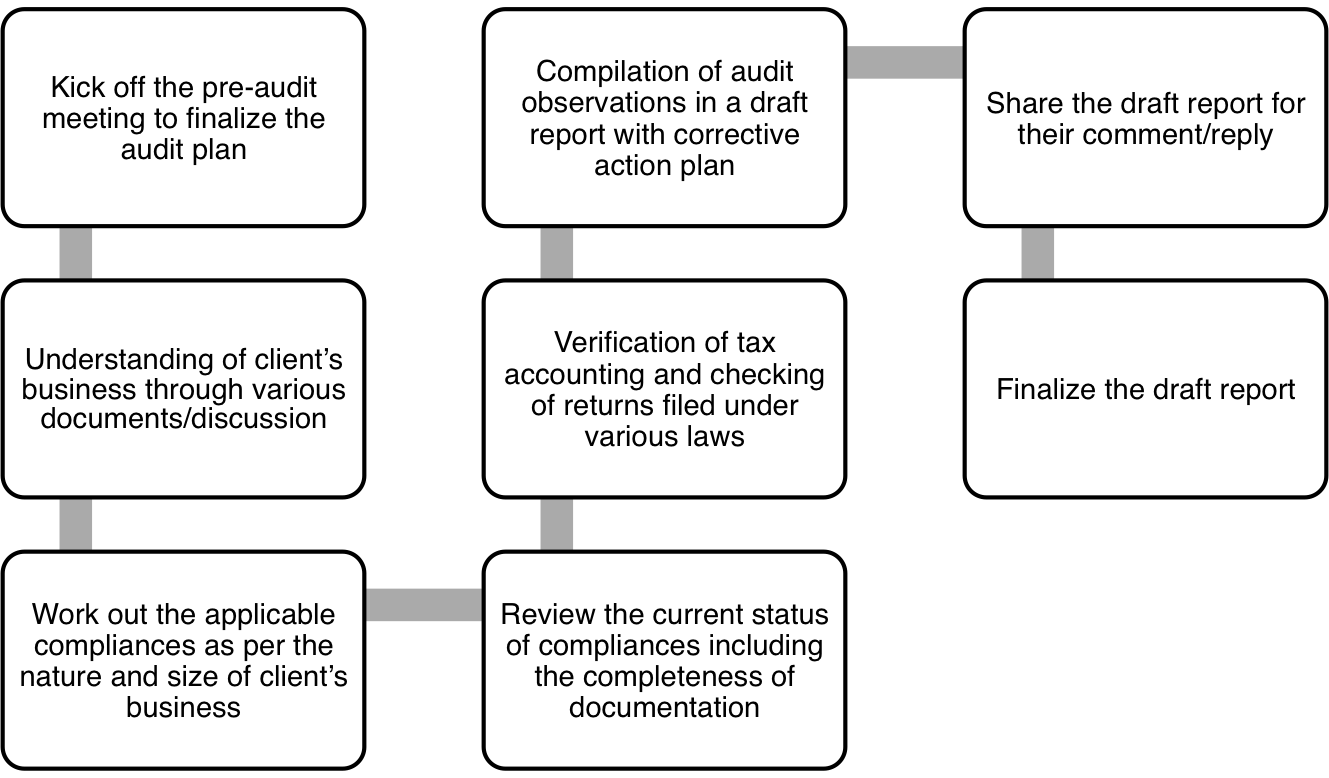

Execution strategy

To see how Blue Consulting can help you in managing Employee Reimbursement, get in touch with us at bdm@blueconsulting.co.in or call us at 0120-4113075 or Click here.